Manage the EU VAT exemption for your B2B customers and add compliance with the new One Stop Shop procedure of the European Union.

A shop owner that sells products or services in the EU needs to know, and fulfil, the requirements of EU VAT laws: our plugin YITH WooCommerce EU VAT, OSS & IOSS helps you to geolocate and identify your European customer’s location and automatically apply the correct VAT rate for B2C orders.

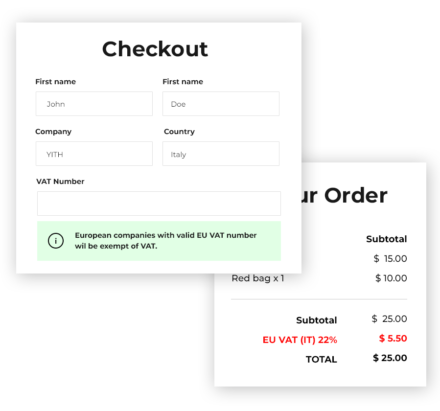

If you sell B2B, this plugin allows you to show a field in the check-out page where businesses can validate VAT and be exempted from VAT at your store.

The plugin is also updated to help you handle the new One-Stop-Shop (OSS) procedure required for all online retailers managing EU sales from 1 July 2021. With this plugin, you can monitor the sales threshold (10.000 €) for B2C exports to other EU countries, generate tax reports (monthly, every 3 or 6 months, yearly, etc.) and export them as CSV to easily notify your local tax authorities about your sales.

Show and customize the VAT field at checkout

Choose whether to require VAT or not during the checkout and how to customize texts.The VAT field can be set as optional or required. If the user doesn’t insert a valid VAT, the purchase process can’t be completed.

The check on VAT validity is made automatically and in real-time: the plugin validates the VAT number using the process of the official method of the European Commission, checking for the presence of the VAT number in the Intrastat records

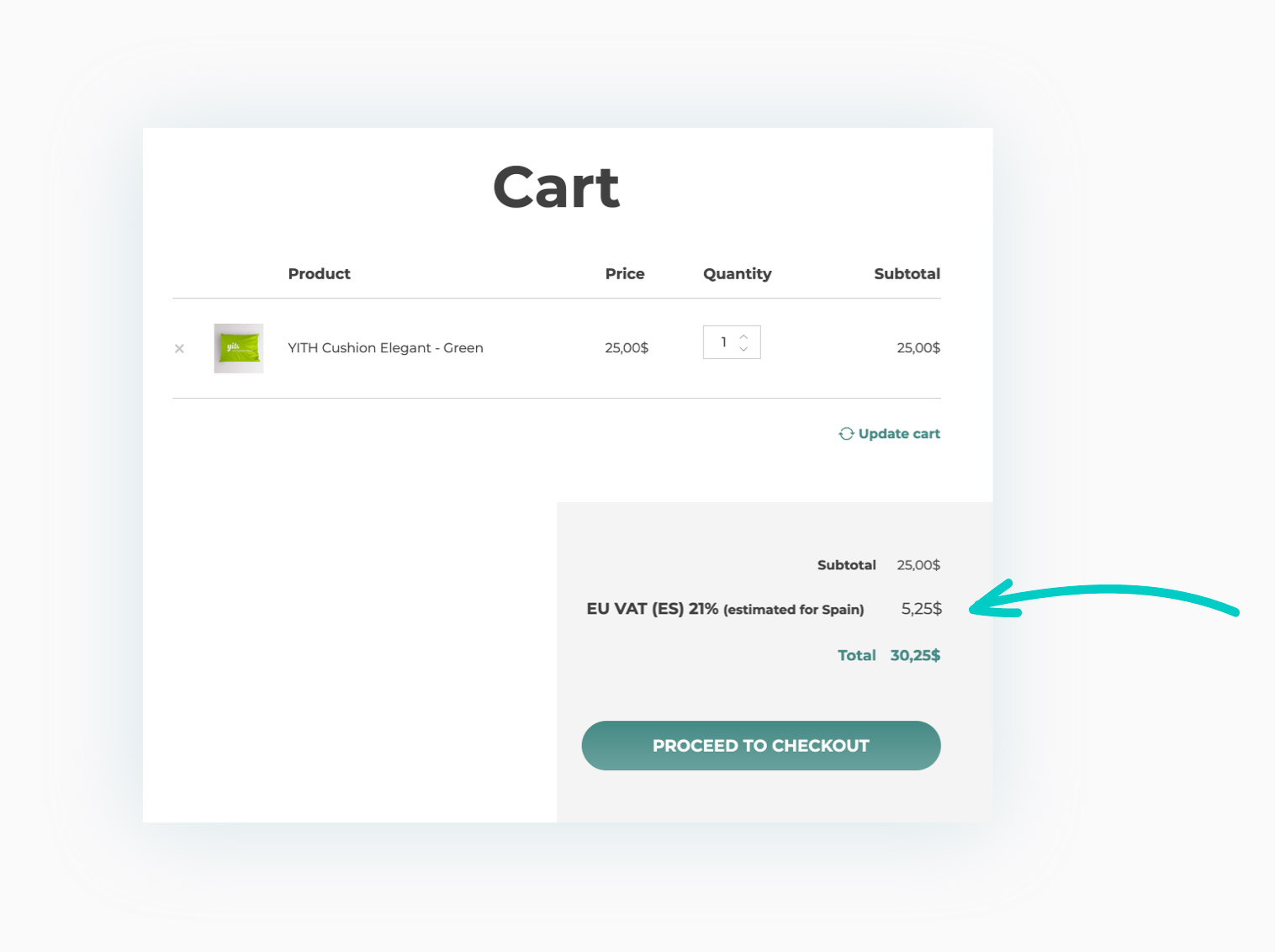

Geolocate users to show the correct VAT according to their countries

The plugin automatically geolocates users who access your shop to show them, on the Cart and Checkout pages, the correct tax based on their country

Import all the European taxes with one click

Save time and efforts: the plugin allows importing all the European taxes in just one click and choosing the countries to enable the VAT exemption

Manage VAT exemption for B2B European Customers

Companies from European countries you have enabled for the VAT exemption can insert their VAT in the checkout page and, after validating the field, won’t pay the TAX for the order

Prevent orders from EU customers

Do you want to allow only customers outside the EU to buy from your shop? With just one click, you can prevent all users from EU countries from placing orders in your shop and show them a notice on the Checkout page

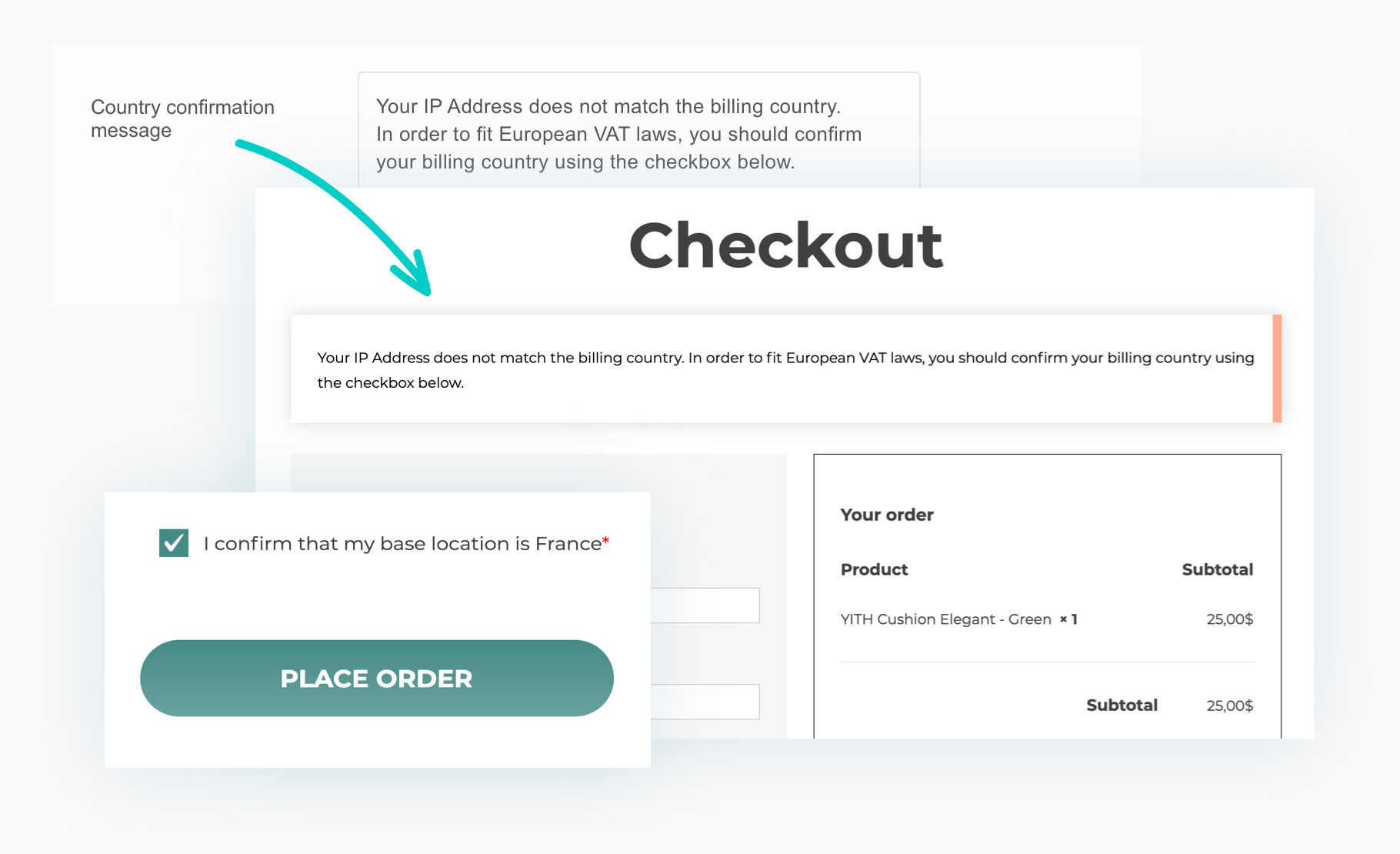

Ask address confirmation if IP and billing address don’t match

If the geolocalization of the IP address detects a missed match between the localized country and the one manually inserted in the billing address, the system will show a warning to the user who will be asked to confirm the country

Enable the One-Stop-Shop procedure and easily monitor the 10.000€ threshold

With just one click, you can enable the new One-Stop-Shop (OSS) regime, required for all online retailers that manage EU sales from 1 July 2021. With this procedure, if your EU cross-border sales stay under 10.000€/year, you can apply your country’s VAT; otherwise, you must apply the local VAT of the buyer’s country

Generate tax reports (monthly, every 3 or 6 months, yearly, etc.) and export them into a CSV

Enabling the OSS procedure, the plugin will automatically create reports that can be exported into a CSV file to quickly update your records with the local tax authorities about your sales.

Enable the IOSS procedure and allow European customers to pay VAT directly on your e-commerce platform (for orders up to €150) instead of paying it at customs

If your shop is outside the EU but registered under the IOSS scheme, you can streamline the purchasing and shipping process for your European customers by directly applying VAT on orders that are under €150 in your shop, thereby avoiding delays caused by VAT payments at customs. The plugin also includes an IOSS reports section.

1 year of updates, bug fixes and technical support

The official plugin license entitles you to one year of updates (and new features that will be added in future versions), error and bug fixes, and access to our technical support platform.

30-Day money back guarantee

Do you have any doubts about the plugin and don't know if it's a good fit for your project? You have nothing to worry about, you can always take advantage of our 100% money back guarantee and get a full refund within 30 days of purchase.

Show more

Show more

primemarketco - verified customer

Reliable solutionThe plugin is incredibly easy to install and configure. I appreciate the simplicity of the settings to fit my needs. The plugin also keeps track of the necessary tax information and generates reports, making it easy to stay on top of everything.

If you run an online store in the EU, this plugin is an absolute must-have. It’s reliable, straightforward, and does exactly what it promises.

Gerald Sanders - verified customer

has offered me what I have neededI found it a very good plugin since my store was small, as it grew and I needed more tax control the plugin responded very well, delighted

rosemary.baxter - verified customer

Perfect to validate VAT numbers and charge the correct %I\'m not one to leave reviews but this plugin is exactly what I was looking for and everyone was super nice in helping me understand how the plugin works and how to configure it all

olivier-0195 - verified customer

Super!Je suis très satisfait, ce plugin est excellent pour la gestion de la TVA.

Pablo T. - verified customer

Buen plugin, rapidez y comodidadEs un plugin genial, para calcular el VAT automáticamente para mis clientes europeos, muy cómodo y hace todo el proceso menos tedioso, lo recomiendo mucho.